Best Life Insurance In Town

At Frontline Protection Pros, we prioritize your peace of mind and financial security. As trusted experts, we provide tailored life insurance solutions to protect what matters most—your family and future. Explore our range of affordable and comprehensive plans designed to meet your unique needs. Secure your legacy with confidence and ease. Welcome to your first step towards a safer, more secure tomorrow. Let's safeguard your future together.

Insurance-based wealth management is a financial strategy that uses insurance to help individuals grow and manage their wealth. Our professional services combine insurance with accounting, tax services, retirement planning, and estate planning to create customized strategies. Our goal is to help you protect your assets, increase your worth, and reduce financial risks.

What Is Life Insurance?

Life insurance is a vital financial tool designed to provide your loved ones with financial security in the event of your passing. It helps cover daily living expenses, outstanding debts, medical bills, and funeral costs, ensuring that your family can maintain their standard of living and manage unforeseen expenses.

Additionally, life insurance policies like whole life or universal life can accumulate cash value over time, which can be borrowed against or used for retirement income. Term life insurance offers substantial coverage at affordable rates, making it ideal for families seeking financial stability during key life stages. Investing in life insurance is a proactive step towards protecting your family's future and achieving long-term financial security.

Life Insurance

At Frontline Protection Pros, we prioritize your peace of mind and financial security. As trusted experts, we provide tailored life insurance solutions to protect what matters most—your family and future. Explore our range of affordable and comprehensive plans designed to meet your unique needs. Secure your legacy with confidence and ease. Welcome to your first step towards a safer, more secure tomorrow. Let's safeguard your future together.

Insurance-based wealth management is a financial strategy that uses insurance to help individuals grow and manage their wealth. Our professional services combine insurance with accounting, tax services, retirement planning, and estate planning to create customized strategies. Our goal is to help you protect your assets, increase your worth, and reduce financial risks.

What Is Life Insurance?

Life insurance is a vital financial tool designed to provide your loved ones with financial security in the event of your passing. It helps cover daily living expenses, outstanding debts, medical bills, and funeral costs, ensuring that your family can maintain their standard of living and manage unforeseen expenses.

Additionally, life insurance policies like whole life or universal life can accumulate cash value over time, which can be borrowed against or used for retirement income. Term life insurance offers substantial coverage at affordable rates, making it ideal for families seeking financial stability during key life stages. Investing in life insurance is a proactive step towards protecting your family's future and achieving long-term financial security.

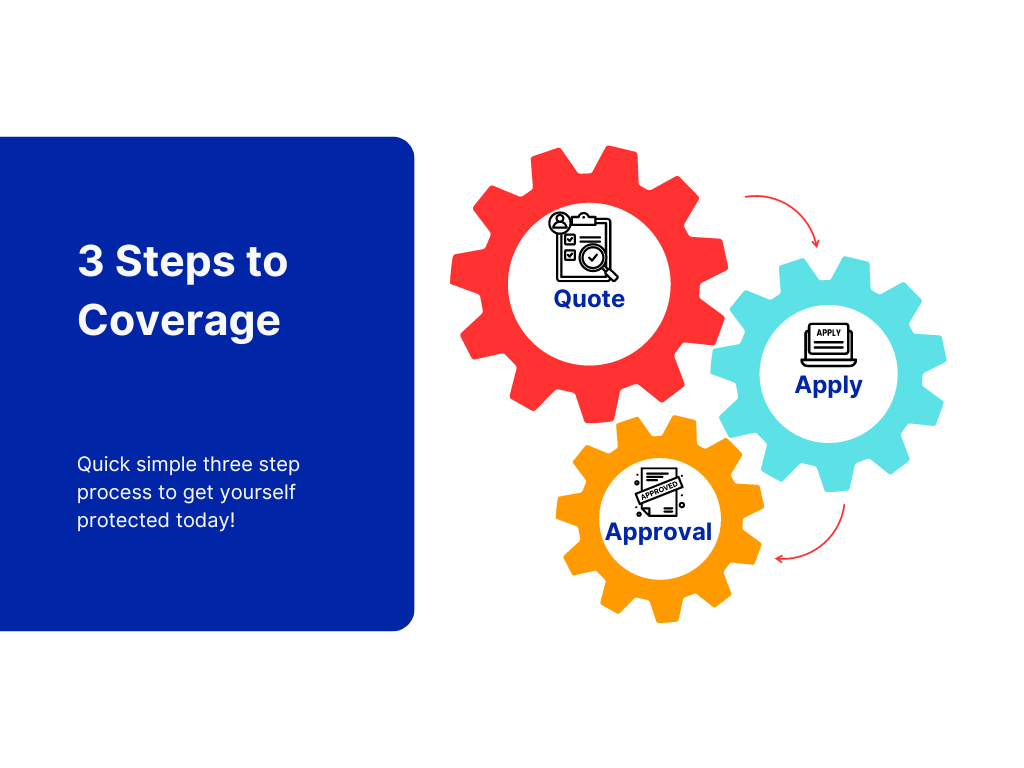

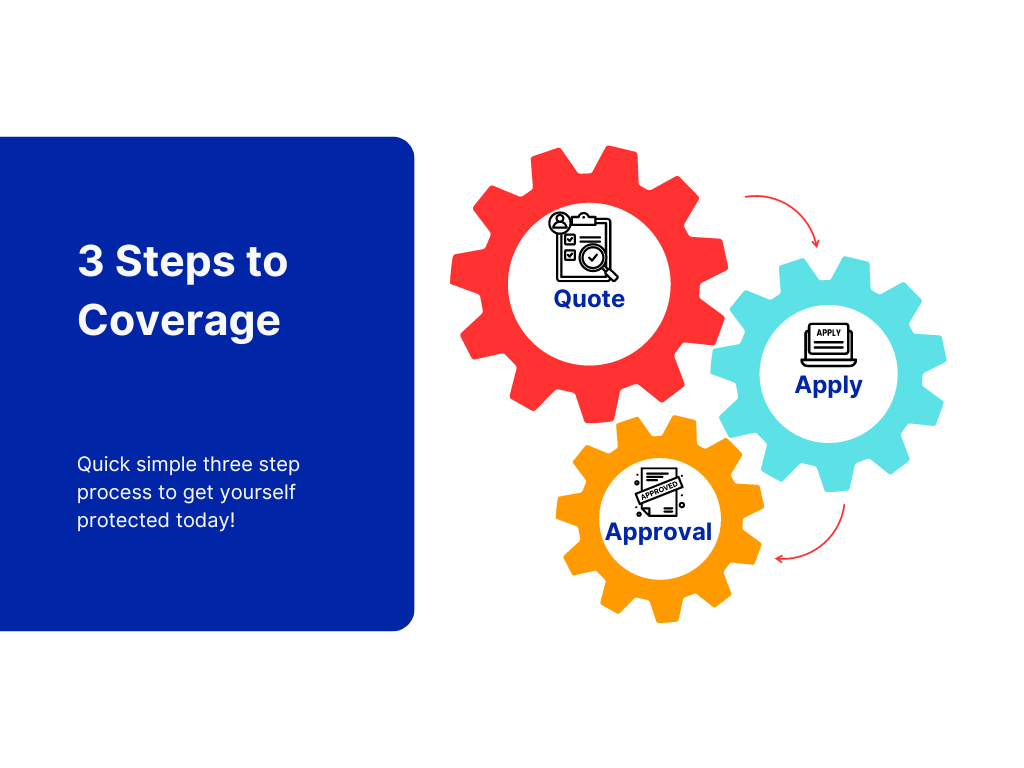

How It Works

Step 1: Get a Quote:

Start by filling out a simple form to receive an initial quote. This will give you an estimate of your premium based on basic information like your age, health, and coverage needs.

Step 2: Apply for Coverage:

Complete a detailed application. This includes providing more in-depth personal and health information, which may involve a medical exam. This helps the insurer assess your risk and determine your final premium.

Step 3: Policy Approval and Activation:

Once your application is reviewed and approved, you'll receive your policy documents. Review and sign them, then start paying your premiums. Your coverage is now active, providing financial security for your loved ones.

4o

Cost of Life Insurance

The pricing of life insurance varies significantly based on multiple factors, including age, health, lifestyle, and the type of policy you choose. These factors influence the risk assessment, which in turn affects the premium rates. To ensure you get the best price, it’s essential to explore different scenarios and options tailored to your unique situation.

The best way to secure the most favorable rates is by booking a free consultation with us. During this session, we’ll review your specific needs and compare offerings from various carriers, ensuring you receive the most cost-effective and comprehensive coverage available.

Meet the Team

Martin Fabbian- Co-Founder

LaBronze Sanderson - Co-Founder

Frontline Protection Pros Specializes In:

Life Insurance

Insurance-Based Wealth Management

Wills & Living Trust

Life Insurance FAQ's

Frequently Asked Questions About

Q: Why Choose Us?

A: At Frontline Protection Pros, we prioritize your family's security and peace of mind. Our expert team offers tailored life insurance solutions to meet your unique needs. We're committed to giving back to our community by donating 10% of our earnings each year to support families of fallen first responders who were not covered. This dedication ensures that those who protect us are also taken care of. Choose us for comprehensive coverage, exceptional service, and a commitment to making a positive impact.

Q: Why do I need life insurance?

A: Life insurance provides financial security for your loved ones by covering expenses such as mortgage payments, education costs, and daily living expenses in the event of your passing.

Q: What types of life insurance are available?

A: The main types of life insurance are term life insurance (provides coverage for a specific period) and permanent life insurance (provides lifelong coverage and includes whole and universal life insurance).

Q: How are life insurance premiums determined?

A: Premiums are based on factors such as age, health, lifestyle, and the amount of coverage you need. Medical exams and personal health history also play a significant role.

Q: Can I change my life insurance policy later?

A: Yes, many life insurance policies offer flexibility to adjust your coverage or convert a term policy to a permanent one, depending on your changing needs.

Q: What happens if I miss a premium payment?

Missing a premium payment may result in a lapse in coverage. However, many policies offer a grace period to make payments before the policy is canceled.

Contact Us

Service Hours

Social Media

Monday - Friday: 9:00 AM - 5:00 PM

Saturday: 09:00 AM - 12:00 PM

Sunday: Closed

2025 | Frontline Protection Pros | Sitemap

Powered By: Termly

How It Works

Step 1: Get a Quote:

Start by filling out a simple form to receive an initial quote. This will give you an estimate of your premium based on basic information like your age, health, and coverage needs.

Step 2: Apply for Coverage:

Complete a detailed application. This includes providing more in-depth personal and health information, which may involve a medical exam. This helps the insurer assess your risk and determine your final premium.

Step 3: Policy Approval and Activation:

Once your application is reviewed and approved, you'll receive your policy documents. Review and sign them, then start paying your premiums. Your coverage is now active, providing financial security for your loved ones.

Cost of [Keyword]

The pricing of life insurance varies significantly based on multiple factors, including age, health, lifestyle, and the type of policy you choose. These factors influence the risk assessment, which in turn affects the premium rates. To ensure you get the best price, it’s essential to explore different scenarios and options tailored to your unique situation.

The best way to secure the most favorable rates is by booking a free consultation with us. During this session, we’ll review your specific needs and compare offerings from various carriers, ensuring you receive the most cost-effective and comprehensive coverage available.

Meet Your Team

Martin Fabbian- Co-Founder

I am an ex-police officer with six years of service, a dedicated father to a beautiful baby girl, and happily married to my wife, whom I met in high school and later came together with. My journey from law enforcement to the insurance industry was driven by a deep desire to make a real difference in people's lives, particularly those who serve and protect our communities.

My passion lies in ensuring that law enforcement members and first responders have the comprehensive coverage they deserve. The plans I offer include living benefits, providing protection not just in the event of death but also in case of injury. Sit down with me, and together we’ll ensure that you and your family are well-protected, no matter what.

LaBronze Sanderson-

Co-Founder

I am a former Fresno Police Department officer with six years of service, during which I responded to numerous calls for service, including high-risk incidents such as violent altercations and high-speed chases. Through these experiences, I witnessed firsthand the challenges and dangers that law enforcement officers confront daily. It became clear to me that our profession often lacks adequate life insurance coverage, leaving officers and their families vulnerable. This realization has fueled my dedication to advocating for improved insurance protections for not only law enforcement personnel but all first responders and their families, ensuring they receive the comprehensive support necessary to safeguard their families' futures.

Married with two children, I am deeply committed to ensuring my family's security should anything happen to me. My personal experiences have underscored the importance of not only protecting our communities but also ensuring that those who serve them are properly cared for. Through my advocacy efforts, I strive to bring about meaningful change in insurance policies for all first responders, advocating for policies that reflect the risks we face and provide the necessary financial security for their loved ones. It is my mission to make a lasting impact in this area and to support anyone I can in every possible way.

Frontline Protection Pros Specializes In:

Life Insurance

Insurance-based Wealth Management

Wills * Living Trust

Life Insurance FAQ's FAQ's

Frequently Asked Questions About

Q: Why Choose Us?

A: At Frontline Protection Pros, we prioritize your family's security and peace of mind. Our expert team offers tailored life insurance solutions to meet your unique needs. We're committed to giving back to our community by donating 10% of our earnings each year to support families of fallen first responders who were not covered. This dedication ensures that those who protect us are also taken care of. Choose us for comprehensive coverage, exceptional service, and a commitment to making a positive impact.

Q: Why do I need life insurance?

A: Life insurance provides financial security for your loved ones by covering expenses such as mortgage payments, education costs, and daily living expenses in the event of your passing.

Q: What types of life insurance are available?

A: The main types of life insurance are term life insurance (provides coverage for a specific period) and permanent life insurance (provides lifelong coverage and includes whole and universal life insurance).

Q: How are life insurance premiums determined?

A: Premiums are based on factors such as age, health, lifestyle, and the amount of coverage you need. Medical exams and personal health history also play a significant role.

Q: Can I change my life insurance policy later?

A: Yes, many life insurance policies offer flexibility to adjust your coverage or convert a term policy to a permanent one, depending on your changing needs.

Q: What happens if I miss a premium payment?

Missing a premium payment may result in a lapse in coverage. However, many policies offer a grace period to make payments before the policy is canceled.

Contact Us

1 844-816-6999

Service Hours

Monday - Friday: 9:00 AM - 5:00 PM

Saturday: 10:00 AM - 2:00 PM

Sunday: Closed

Social Media

2025 | Frontline Protection Pros | Sitemap